Product Details

Flexicare Mini - Health Insurance Plan

N2,000/Monthly

After 24 hours, you stand to benefit.

- Inpatient Limit - up to ₦400 000

- Outpatient Limit - up to ₦250 000

- Pharmacy - up to ₦50 000

- Hospital Access - 1,932+ C-D Hospitals

- General Consultation - Access to treatment for basic medical outpatient and in-patient cases including microbiology tests.

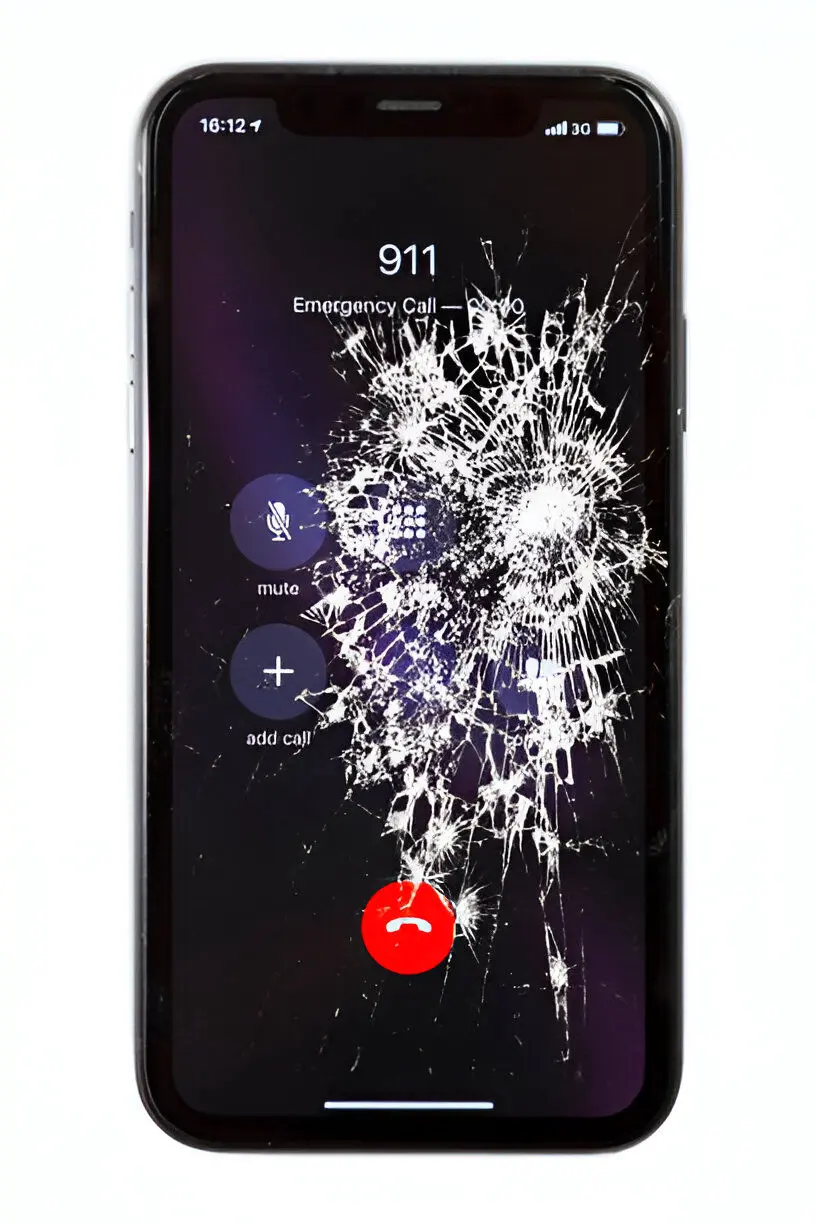

- 24-hour Telemedicine - Free consultation with health experts when needed for routine medical information and emergencies.

- Accident and Emergency care (up to ₦50,000 per year).

- Diagnostics and imaging.

- Laboratory Tests.

- Admissions and Accommodation General Ward (10 Days per year).

- Physiotherapy Care Physiotherapy limit of ₦15 000. Drugs are covered up to Pharmacy limit.

- Family Planning up to ₦7,000 limit.

- HIV care and treatment.

- Seeking Second Opinion Covered within HMO network.

After 4 months of steady subscription, you stand to benefit;

- Eye care up to ₦5,000.

- Primary Dental care up to Dental limit of ₦5,000.

- Secondary Dental care up to Dental limit of ₦5,000.

- NPI Immunization ( 0 - 5 Years ) for BCG, OPV, DPT.

After 7 months of steady subscription, you stand to benefit;

- Minor surgeries up to ₦70,000.

- Intermediate surgeries up to ₦70,000.

- Major surgeries up to ₦70,000.

- Wellness checks for BMI, General Physical Examination, Blood Pressure and Blood Sugar covered.

After 11 months of steady subscription, you stand to benefit;

- Obstetrics Care up to Maternity limit of ₦50,000.

- Neonatanal Care up to Outpatient limit